America: Leashed Up by Chinese Magnets

Magnets are the powerful new industrial magic. China owns them. America needs them.

Images of the spectacular B-2 stealth bomber raid over Iran this week reminded everyone that America’s military can project overwhelming power anywhere on earth at any time.

Much less well-known: America cannot build a single guided missile without permission from Beijing. That is not a hyperbole. It’s the stark reality of America’s dependence on Chinese rare earth magnets, the hidden components that power everything from F-35 fighter jets to wind turbines to Tesla Model 3s.

Until a few weeks ago, China’s overwhelming dominance of the magnet sector went mostly unnoticed. China supplied, and the West happily bought. But in May, China sent shockwaves through America’s defense industry and the automotive business when it abruptly blocked magnet exports.

Among their many uses, the auto industry needs rare earth magnets for alternators, sensors, motors, fuel pumps, transmission systems, entertainment systems, vehicle electronics, and exhaust systems. A typical EV uses between two and five kilograms of rare earth magnets.

Ford was forced to shut down production for a week. German automakers warned of production lines coming to a standstill. "The whole car industry is in full panic," said Frank Eckard, CEO of German magnet maker, Magnosphere earlier this month. "They are willing to pay any price."

The message was abrupt and unmistakable: China holds the supply chain equivalent of nuclear weapons. Without magnets, American and European cars do not get built.

America led the world

In the 1980s, America utterly dominated the rare earth industry. Molycorp’s Mountain Pass mine in California supplied most of the world’s rare earths, while General Motors’ Magnequench subsidiary pioneered permanent magnet manufacturing. The United States controlled both the raw materials and the cutting-edge technology.

China began flooding global markets with cheaper rare earths, subsidized by state investment and environmental externalization. American companies, focused on quarterly returns rather than strategic capabilities, found it easier to source from China than to compete.

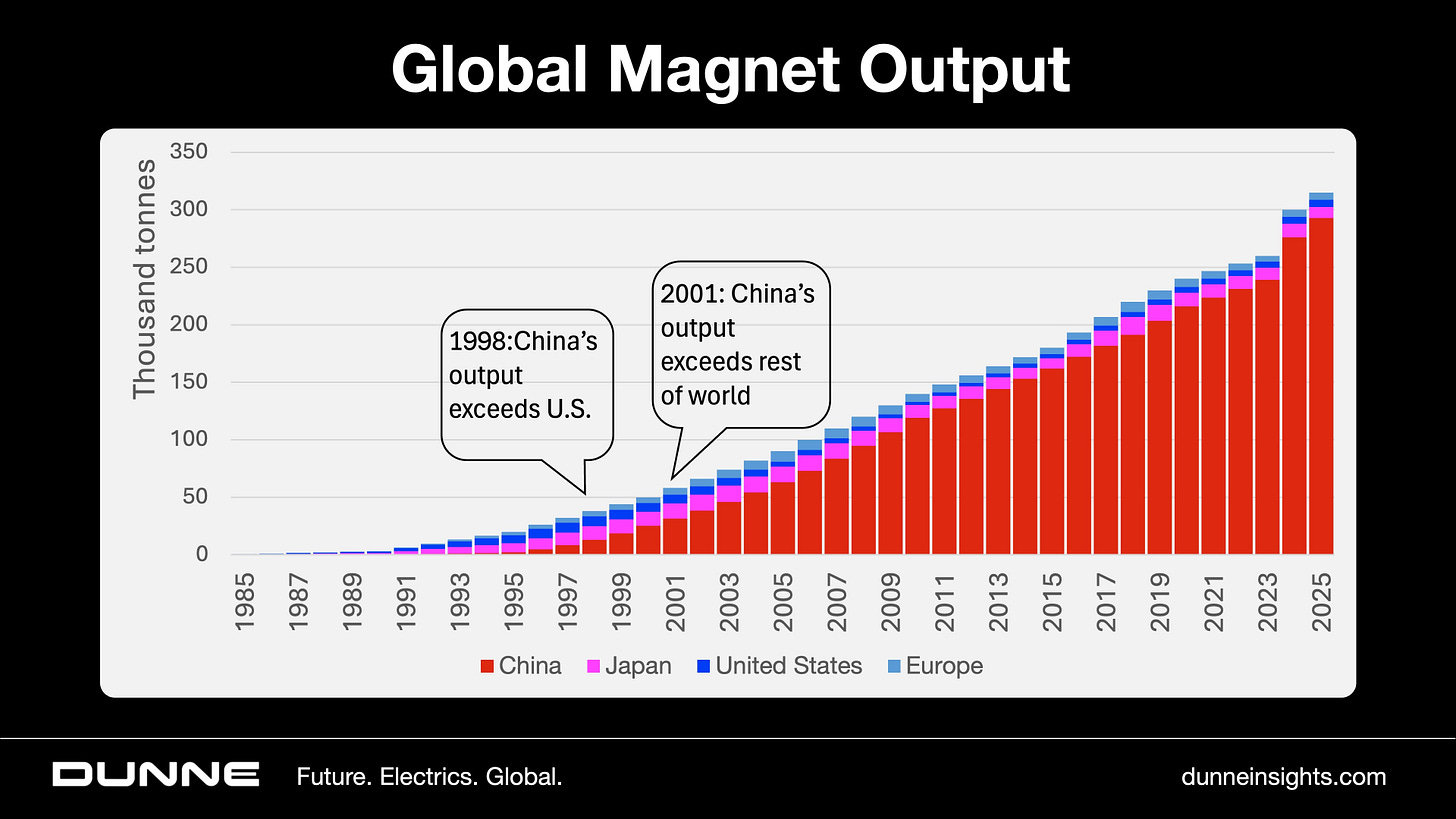

The global production shift tells the story in stark numbers:

In 1985, the U.S. controlled 60% of rare earth production and China just 30%. By 2024, China had achieved near-monopolistic control over the entire supply chain, from mining to processing to finished magnet manufacturing. China now controls 90% of global neodymium magnet production while the U.S. produces a paltry 0.3%.

The Magnequench Betrayal

The most devastating blow came not from Chinese industrial espionage but from American corporate short-sightedness. In 1995, General Motors sold Magnequench for $56 million to what appeared to be Sextant Group, led by Archibald Cox Jr. In reality, Sextant was a front for two Chinese state-linked companies with ties to Deng Xiaoping’s family.

Pentagon officials advised against the sale, recognizing that Magnequench supplied 85% of the rare earth magnets used in American guided missiles and smart bombs. They were overruled by the U.S. State Department, which was eager to better relations with China. Mr. Cox promised workers that production would remain in the U.S. for at least a decade. Instead, he began shutting down American plants within three years.

By 2004, the last U.S. Magnequench facility closed, with 450 workers fired and machine tools shipped to China. America’s defense industrial base had been hollowed out for $56 million: the cost of a single F-35 fighter jet.

China simultaneously targeted other critical nodes in the supply chain. When Molycorp’s Mountain Pass mine faced environmental challenges and regulatory pressure, Chinese competitors exploited the opportunity. The facility closed in 2002, ending American rare earth production entirely.

Giant Gap

Today, the United States is at least 10-15 years behind China in state-of-the-art permanent magnet manufacturing at scale. The numbers are staggering: China produces 300,000 tonnes of NdFeB magnets annually, while U.S. capacity is projected to reach barely 6,000 tonnes by 2027, less than 2% of Chinese output.

The capability gap extends beyond raw production volumes. China controls 90% of global rare earth processing, the complex separation chemistry required to transform mined ore into magnet-grade materials. Even when the U.S. mines rare earths, the concentrate often goes to China for processing because America lacks the technical infrastructure.

This dependency creates cascading vulnerabilities. The U.S. Navy’s entire fleet relies on Chinese magnets. American automotive manufacturers operate on “hand-to-mouth” inventory systems, vulnerable to supply disruptions. Ford CEO Jim Farley described the current situation in plain words: “It’s day to day… We have had to shut down factories.”

China’s Economic Weapon

China’s April 2025 export restrictions demonstrated how Beijing can weaponize rare earth dominance. The new rules require individual export licenses for seven critical rare earth elements, including samarium, dysprosium, and terbium, materials essential for high-performance military applications.

The impact was immediate and severe. Chinese rare earth magnet exports halved from April to May 2025. German automakers, the largest importers, saw shipments reduced by 50%. American defense contractors faced potential production shutdowns for weapons systems.

Faced with economic coercion, the United States agreed to relax export restrictions on jet engines, ethane, and nuclear equipment in exchange for resumed Chinese magnet shipments under a licensing system. Beijing retained restrictions on military-grade magnets and imposed six-month licensing caps to maintain leverage.

The symbolism was unmistakable: America traded advanced aerospace technology for access to processed earth elements. The negotiation revealed how China had transformed commoditized materials into strategic weapons.

The Long Road Back

American companies are finally awakening to the strategic threat, but rebuilding will take decades. MP Materials has reopened Mountain Pass mining and built a magnet facility in Fort Worth, targeting 1,000 tonnes annually by 2025. USA Rare Earth plans a 5,000-tonne facility in Oklahoma. Ucore Rare Metals is constructing processing capabilities in Louisiana.

The Department of Defense has committed $439 million since 2020 to rebuild domestic supply chains, aiming for complete “mine-to-magnet” capability by 2027. The goal might meet defense requirements, the DOD needs roughly 1,200 tonnes annually, but commercial and industrial demands will remain import-dependent for years.

The feedstock challenge remains daunting. While some projects like MP Materials achieve vertical integration from mine to magnet, most facilities still depend on imported concentrates during ramp-up phases. Heavy rare earth separation, critical for high-performance defense applications, has zero current U.S. capacity outside laboratory scale.

A new company named Evolution Metals and Technologies is addressing the feedstock issue by focusing on creating a U.S.-based supply chain for processing rare earths and recycling lithium-ion batteries.

Leverage Play

American rebuilding efforts face constant threats of Chinese price manipulation. When Molycorp attempted to revive Mountain Pass in 2010, China flooded markets with below-cost materials, driving the company into bankruptcy by 2015. Beijing demonstrated that it will sacrifice short-term profits to maintain long-term strategic control.

The geopolitical implications compound over time. As America’s technological edge in aerospace and defense depends increasingly on Chinese-controlled materials, Beijing gains influence over U.S. military capabilities. Every advanced weapons system becomes a hostage to Chinese supply chain decisions.

China’s strategy represents economic warfare through industrial policy: using state resources to control critical supply chains and leveraging that control for political and economic concessions. The rare earth magnet industry exemplifies how authoritarian capitalism can systematically undermine democratic market economies.

Conclusion: Time for Action

America stands at a crossroads reminiscent of World War II, when the nation rapidly transformed civilian industry to meet existential threats.

Each month of delay allows China to consolidate its advantages further, making future competition more expensive and difficult.

The rare earth magnet industry reveals a fundamental question about America’s economic future: Can democratic market economies compete against authoritarian state capitalism in industries requiring massive, long-term investment and political will?

American policymakers must choose between accepting permanent strategic dependence on adversaries or committing the resources necessary for genuine supply chain independence.

America, this is not a rehearsal.

It would take the combined efforts of at least three Administrations, six Congresses, thousands of geologists/geochemists, 15 years and $100 billion to match what China has today.

What China has today is 42,000 REM patents (covering extraction to recycling), four geological universities and 500,000 geologists. One of those 500,000 was Prime Minister of China who cleaned up the chaotic RE mess and turned it into the powerhouse it is today, then went back to teaching geology..

Meanwhile, while we fantasize about building an RE supply chain, we're still shipping industries like naval maintenance(!) offshore.

Practically speaking, the RE gap between us and China is unbridgeable. Checkmate?

> But in May, China sent shockwaves through America’s defense industry and the automotive business when it abruptly blocked magnet exports.

Abruptly blocked? That’s a little disingenuous, as if China inexplicably and unfairly blocked exports; nothing to do with Trump’s sanctions, tariffs and warmongering.