America's Battery Blitz

Hyundai, LG, Redwood Materials, Toyota, NIO, CATL, Veoneer, Tesla, Mexico

The Big 5 This Week

1. Battery Blitz: Automakers and battery manufacturers have announced plans to invest an astounding $60 billion into North America. Work on US-Canada-Mexico battery supply chains comes next: cells, cathodes, anodes, refining, minerals, recycling and, of course, enough grid capacity to power millions of EVs. The American Battery Materials Initiative is designed to accelerate the process. Link

2. EV Reality Check. When asked what share of global car markets EVs would take by 2030, the most optimistic CEOs responded 40%, down sharply from 70% level in 2021. Scarce minerals, higher costs have them thinking twice about volumes. Link

3. Redwood Materials. Redwood Materials - led by Tesla co-founder JB Straubel - just announced a $3.5 billion investment into South Carolina to recycle batteries. Link

4. DC Buying Time. Lawmakers in DC have announced that new rules around EV tax credits will not be ready until the end of March, 2023. Link

5. Tesla’s $600 Billion Wipeout. Elon says that higher interest rates are drawing investors away from the stock market and into treasuries. Tesla’s value has declined by $600 billion this year. Link

Epic Quote: “Race cars are neither beautiful or ugly. They become beautiful when they win.” - Enzo Ferrari

Toyota’s Surprising China Success. Despite thin EV offerings, Toyota continues to gain market share in China. FAW-Toyota, a JV formed in 2003, has now delivered 10 million cars to Chinese customers. Toyota also partners with Guangzhou and BYD in China. Link

Future EVs, Batteries, Charging

Electrics

NIO House / Germany. NIO opened its first NIO House in Germany this week, its second in Europe. Can NIO duplicate the NIO House experience outside of China? Do Europeans want it? Link

Vamos Mexico / Tesla Monterrey. Tesla is expected to announce plans for a new gigafactory in Mexico this week. The Kansas-Texas-Mexico belt gathers momentum. Link

Indonesia $5,000. Buyers of electric cars in Indonesia may soon be entitled to a $5,000 subsidy. The incentive is designed to ignite demand for electrics in Indonesia where EVs now account less than 2% of sales. Link

Batteries

CATL / Ford. Word on the street is that Ford and CATL are discussing an arrangement that features Ford ownership of a battery plant powered by CATL technical expertise. Link

American Battery Factory. This American startup will invest $1.2 billion to build LFP batteries in Arizona. Celgard and Anovion (for graphite) are key battery tech partners in the enterprise. Link

Group14. Seattle-area developer of a silicon technology to replace graphite in lithium-ion batteries has raised a fresh $214 million. This comes on top of the $100 million grant secured from the US federal government last month. Link

Charging

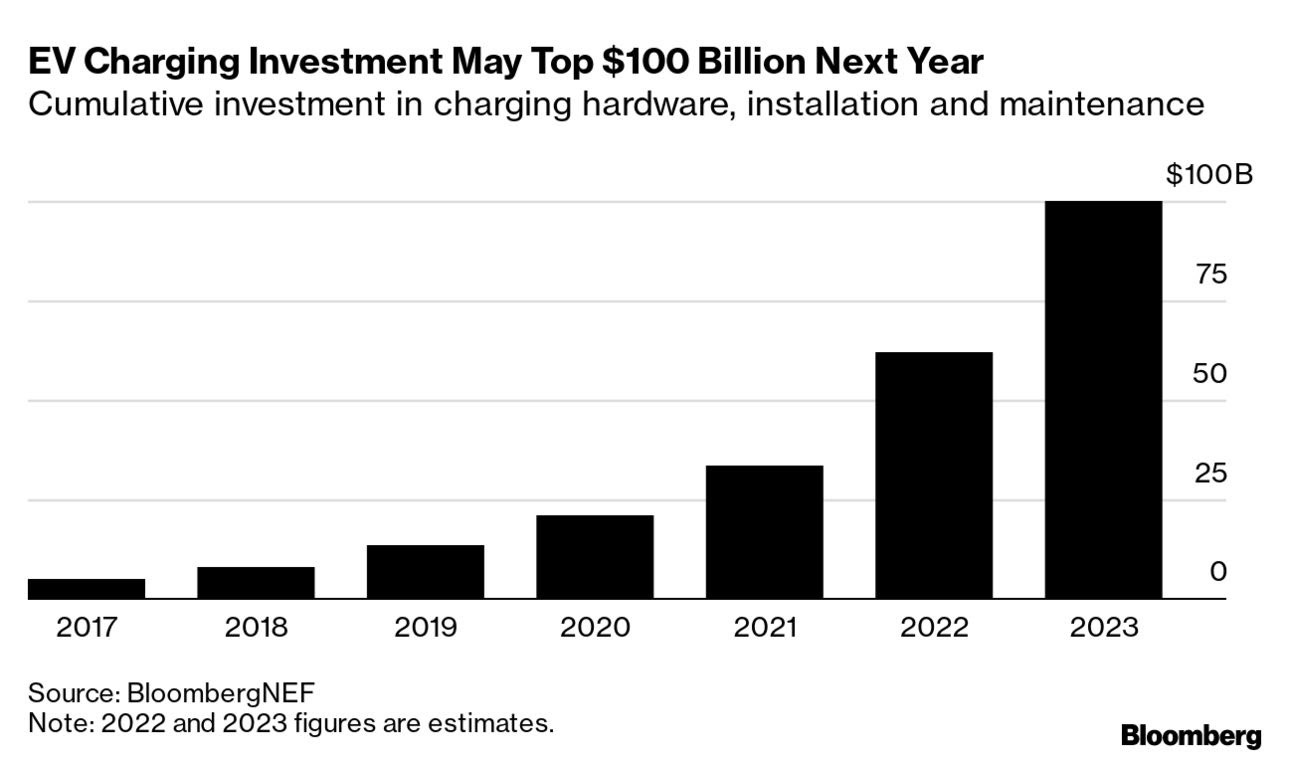

Investments Into Charging. Investors and governments have poured nearly $200 billion into charging networks since 2020, led by China. Mediocre charging networks have become the single biggest limiter to widespread EV adoption in America. Link

New Deals / Milestones

Veoneer. Magna is acquiring Veoneer Active Safety for $1.5 billion, further evidence that the money is in ADAS not complete autonomy. Link

CATL Ramps In Germany. China’s No. 1 battery maker has started battery cell production in Germany. Separating German GmbH from China just got harder. Link

Comparing ADAS GM vs. Tesla vs. Ford. Not all systems are the same. This reviewer has Tesla in third place. Link

A Revolution to Make Cities More Human-Centric

“If it can be done in Brussels, it can be done anywhere.”

Guest: Elke Van den Brandt, Minister of Mobility, Brussels

The Driving With Dunne Podcast

Listen to the Driving With Dunne podcast via Apple, Spotify, Amazon or wherever you take your podcasts.

Follow ZoZoGo on Twitter, LinkedIn and YouTube.

Visit: www.zozogo.com