BYD: So Damn Good – But Not Invincible.

What Warren Buffett Might Be Thinking

So Damn Good – But Not Invincible.

Not a lot of people talk about it, but Warren Buffett has been aggressively shedding his BYD holdings.

Since late 2022, Buffett’s Berkshire Hathaway has reduced its ownership in BYD by more than half. Those sales are shares it had owned since its prescient investment way back in 2008.

Berkshire now owns less than 5% of BYD.

Now here’s the strange part: Warren has been selling shares at a time when BYD is hitting full stride - growing faster than any other automaker in the history of cars.

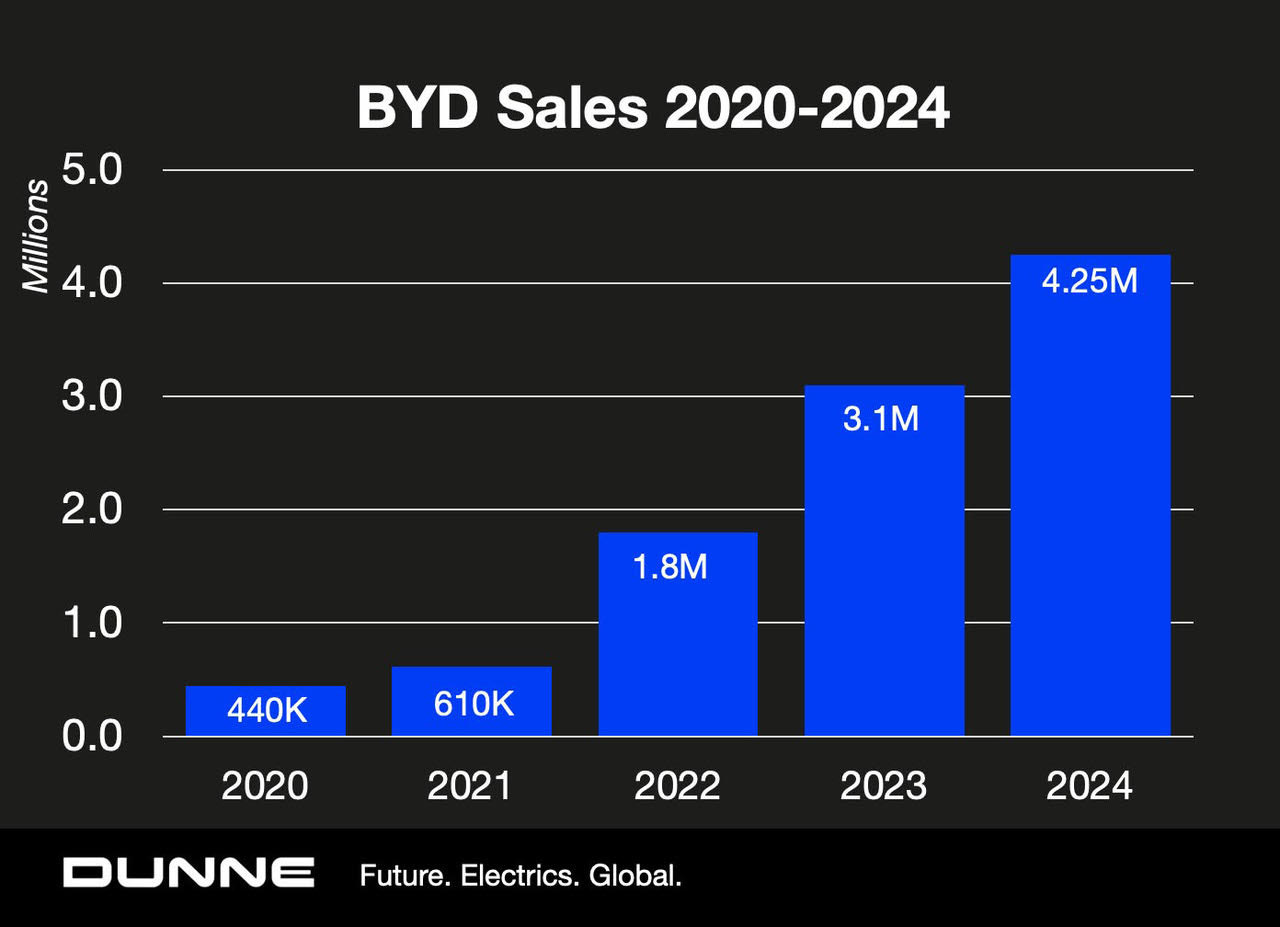

BYD deliveries are up 10x since 2020, from 400,000 to more than 4 million per year.

What makes this high-velocity industrial sprint even more stunning is that BYD sales actually fell for three consecutive years between 2018 and 2020.

Now, suddenly, BYD is bigger than Ford, Honda or Nissan.

Investors not named Warren Buffett are entranced. BYD is now worth $105 billion. That makes BYD the third most valuable automaker in the world after Tesla and Toyota.

Okay, perhaps Warren is just taking profits, being smart.

Or maybe, just maybe, the Oracle of Omaha senses something that everyone else is missing. What might that something look like?

Reader: “Wait a sec, Dunne. Before we go deeper on Buffett, first remind us how BYD got so good so fast.”

Dunne: “Oh, right, of course. Let’s do that.”

The reality is that competitors today genuinely respect - and fear - BYD.

After a visit to BYD headquarters in 2023, Toyota’s EV head, Takero Kato, came back to Japan and announced: “We’re in trouble!”

Ford CEO Jim Farley recently called BYD products “an existential threat” to Ford’s business.

Here is why:

Vertical Integration: Building 80% of its parts in-house lets BYD produce vehicles at 25% lower cost than established automakers in the West.

Blade Battery. BYD has designed arguably the world’s safest and most efficient battery. The Blade lithium-ion phosphate battery is so good that rival Tesla sourced the Blade for some of its Model Y production in Berlin.

Product Range: BYD offers the full spectrum of cars and SUVs, powered by battery-electric or plug-in hybrid propulsion systems. Prices start at $9,700 for the Seagull and run up to $223,000 for the Yangwang U9 supercar.

Design. Under the leadership of Audi-trained Wolfgang Egger, BYD’s 600-plus team of designers are creating very fresh, good-looking cars, like the BYD Seal.

R&D/Patents. BYD has 110,000 engineers on staff, the most of any auto company in the world. By the end of 2024, the BYD team had filed an astonishing 29,000 global patents.

Confidence. BYD is not staying home. The company exported 400,000 cars in 2024, including 40,000 to Mexico. This year the target is 800,000. To speed delivery, BYD recently launched the Shenzhen, the world largest car carrier ship and BYD’s 4th roll-on, roll-off ship since 2024.

So much winning.

BYD appears to have turned into a legitimate global powerhouse. So, what could be causing Warren Buffett to unload shares?

A closer look reveals some potential cracks:

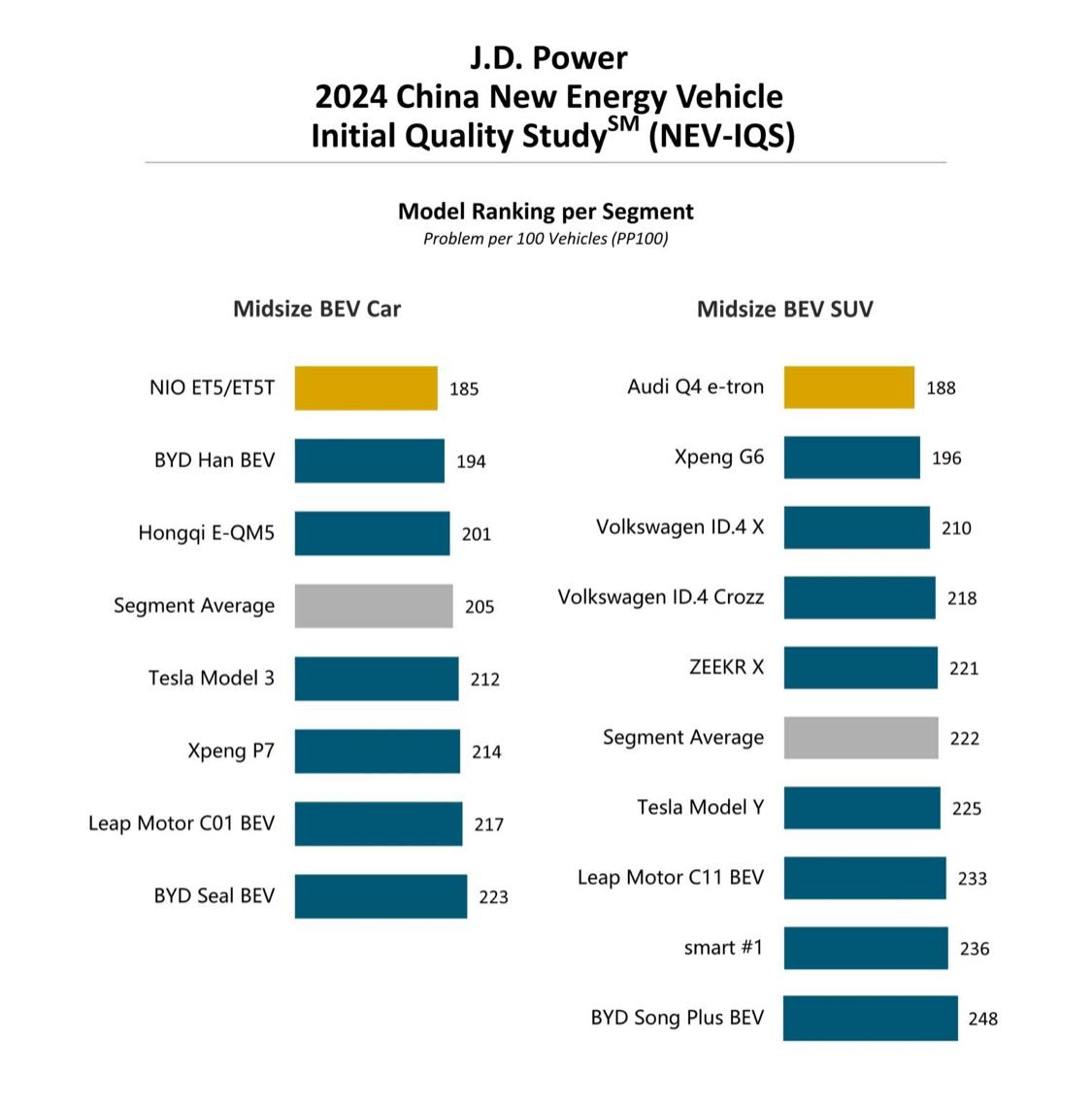

Uneven Quality. According to the JD Power China 2024 IQS study, the BYD Seal and the BYD Song Plus finished at or near the bottom in quality rankings. Manufacturing execs in the industry tell me it is next to impossible to increase output 10x in four years and not have quality issues.

Labor Standards. Authorities in Brazil temporarily shut down BYD operations at the end of December. A total of 163 of those workers at a construction company hired by BYD were found to be working in what Brazilian authorities said were "slavery-like conditions." BYD is learning that accepted labor practices at home in China may not translate overseas.

Trade Fireworks. With recent 100% tariffs on Chinese cars imported into the U.S. and Canada, and a flat ban on Chinese software and hardware in connected cars, North America has delivered a giant 'Not Welcome Here' message to BYD and every other Chinese maker. Europe, too, has lifted tariffs on BYD imports. BYD sold fewer than 3,000 cars in Germany last year. Brazil and Mexico are looking to beef up tariff and non-tariff protections after being inundated with cars from China in recent years.

Over Dealering. When I talk to BYD dealers in places like Brazil, Thailand and Indonesia, there are two recurring themes. They love the BYD products. They are much less happy about BYD’s tendency to promise a market area to one dealer only to give new outlets to other dealers in the same area a few months later. When that happens, profits slide to zero in a hurry. “The honeymoon was short and it’s already over. There’s no money” is how one dealer in San Paulo, Brazil put it.

Complex Brand Portfolio. BYD is building four core brands at the same time, which can be expensive and distracting: BYD, Denza, Fangchengbao and Yangwang.

Supply Chain Financing. Bloomberg reported this week that BYD debt may be larger than it appears. “However it’s structured, it’s clearly a form of hidden debt.” [BYD] is using sleight of hand to present these liabilities as part of working capital, says Nigel Stevenson of GMT Research in Hong Kong. BYD took an average of 275 days to pay suppliers in 2023.

All of these issues, of course, may be manageable. BYD has enough employees - nearly 1 million in total - to power through these growing pains.

But there is one more danger lurking in the horizon. And it’s a big one.

The US and China are engaged in an intense battle for supremacy over next generation technologies. BYD, fairly or not, is seen as the tip of the CCP spear when it comes to EVs and batteries.

Warren Buffet, more than anyone, would understand this risk.

In 2023, Buffett sold every last one of his shares in TSMC, the world’s largest and most profitable chip maker, headquartered in Taiwan.

When asked about the thinking behind the move, Buffett was succinct: “I don’t like its location.”

Warren might know a thing or two.

Interesting article. Living in China, BYD vehicles are everywhere here. The other big challenge they face is oversaturation of their home market. In big cities like Guangzhou - where I am - NEVs already have around 80 percent of the market. There's more room for growth in smaller cities and rural areas but this is still going to become a more challenging market once everyone who wants an NEV has one. On batteries CATL is a bigger player than BYD and CATL is working with multiple smaller NEV manufacturers to produce a common battery/chassis using swappable battery technology. It makes sense to think that BYDs boom years are coming to an end, but it still seems a good stable financial bet.