How China Is Gutting Western Automakers

The Formula: Scale Up. Flood In. Starve Out.

“Make the world more dependent on China. Make China less dependent on the world.” – Xi Jinping (Politburo, Dual Circulation Strategy, May 2020)

If China’s goal is total domination of the global auto industry, the master plan might look something like this:

Scale Up: Build enough capacity to supply more than half of the world’s annual demand for vehicles.

Flood In: Launch a frenzied push of exports into markets worldwide and, with aggressive pricing, take large chunks of market share.

Starve Out: Restrict competitors access to key material and manufacturing inputs, thereby limiting their ability to build competitive products.

For maximum impact, you would take these actions at hyper speed, crunching a decade of effort into the space of just a few years. This is precisely what the PRC has been doing since 2021.

Just look at the numbers.

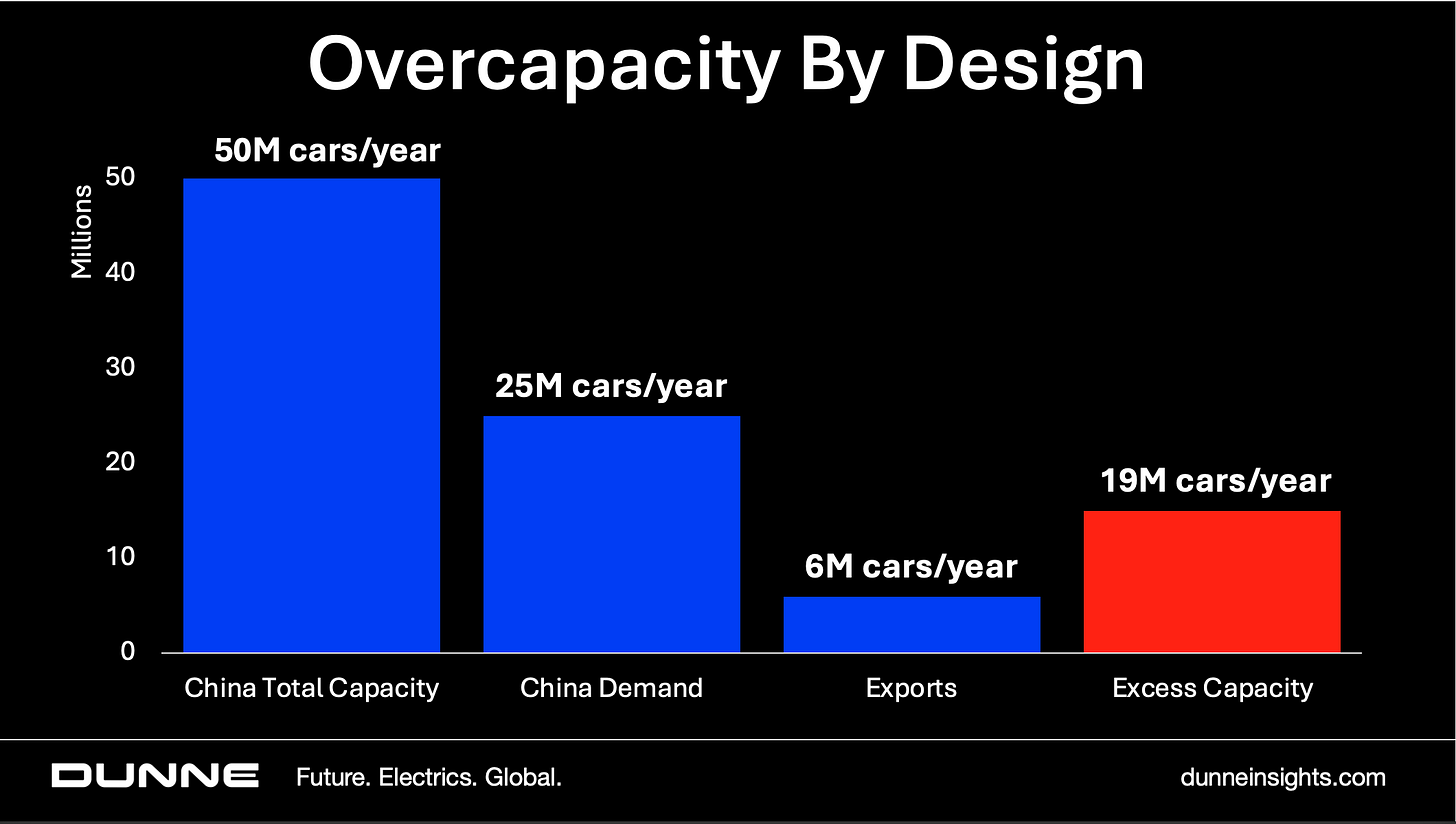

China today has enough annual capacity - 50 million – to supply 55% of global demand for vehicles. By comparison, the world’s next largest automotive manufacturing nation, America, builds just 10 million cars a year.

This extreme overcapacity has ignited brutal price wars at home, causing profits to vanish. This is forcing Chinese automakers to face an ultimatum: export or die.

The Flood In

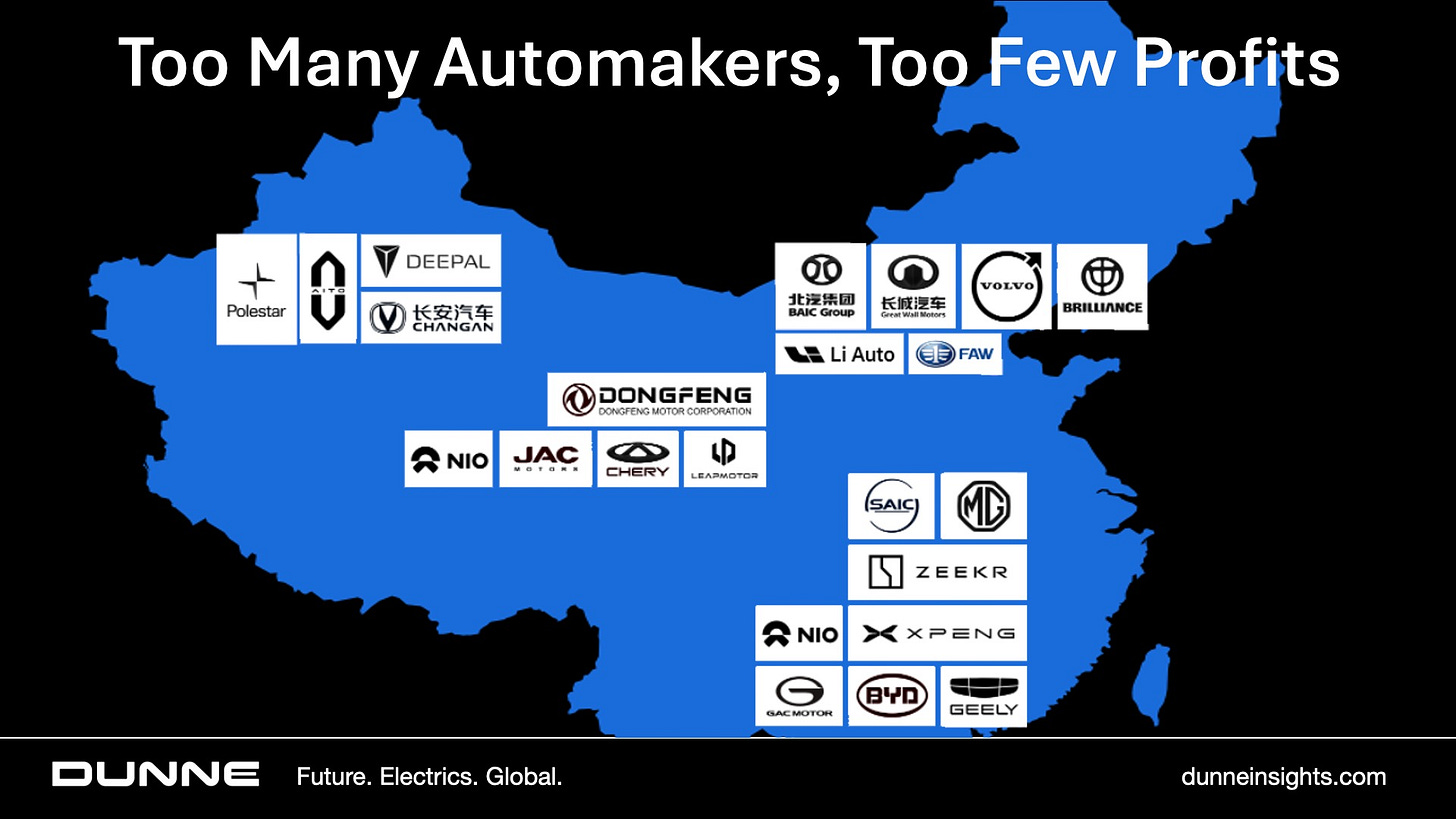

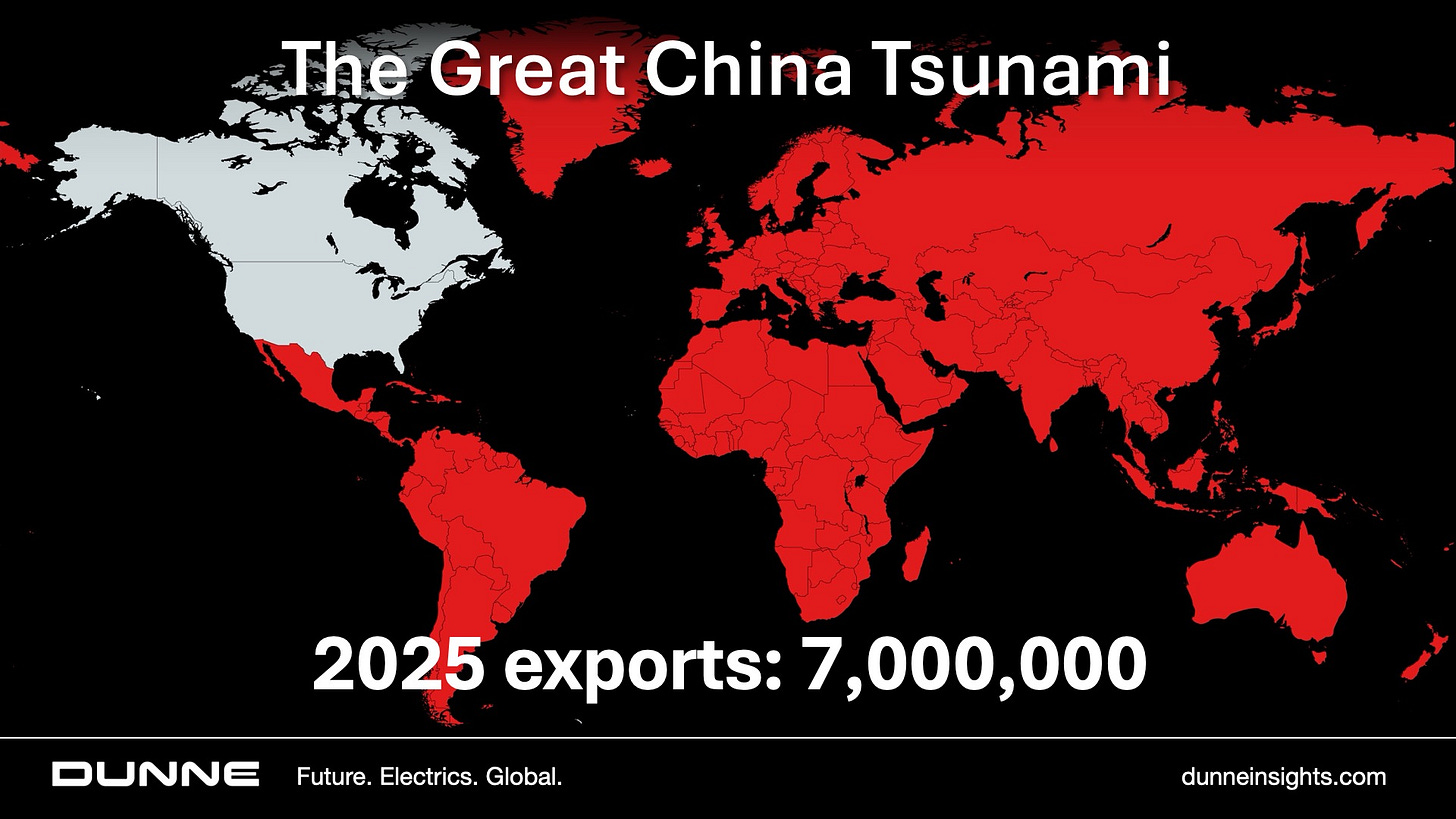

No one wants to die, of course, including China’s 107 car companies. So, China this year will export a world-record seven million vehicles to more than 100 countries worldwide, up from just one million in 2020. Chinese cars are pouring at a breathtaking pace into virtually every nation in every time zone – except the United States and Canada. Never in hundred years has the auto industry witnessed such explosive growth in exports from a single country.

Clearly, there’s more than natural market forces at work here.

Last week, I was back in the UK, visiting Chinese dealerships where MGs, BYDs and Chery Jaecoos are flying out of showrooms. BYD sales in September topped 11,000 cars, up 880% over the same month in 2024.

The UK is now BYD’s largest market outside of China.

Over lunch in London with Peter Fleet, former CEO of Ford China, I learned that BYD and other Chinese brands plan to be market leaders by 2030. “The Chinese accounted for 13% of new car sales in September,” Fleet said, “and I have that number going to 30% within two years.”

Western automotive leaders seem stunned and confused, like deer in headlights. The rapid Chinese advancement, says Ford CEO Jim Farley, is “the most humbling thing I have ever seen.”

The Starve Out

Farley and his peers in the West know that they need to deliver ultra-competitive products or they will soon be out of business. Unfortunately, they risk never getting out of the blocks. China last week announced limits on exports of key automotive manufacturing materials from rare earth magnets to battery materials.

Without these inputs, factories in Europe and the US will come to a standstill, as happened to Ford earlier this year.

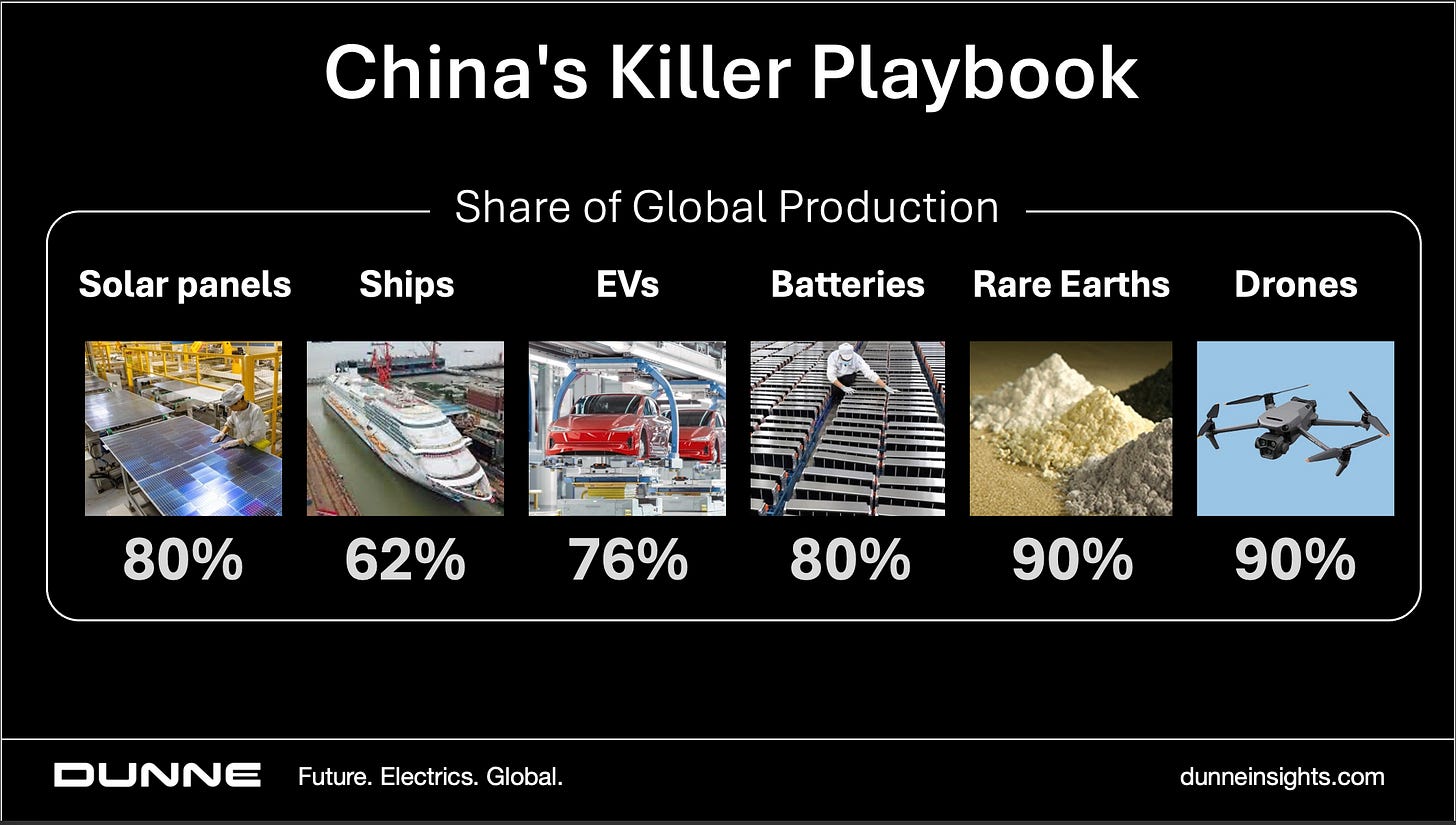

Rare earth magnets are the most extreme example of China’s tight grip on pivotal inputs. Every car has hundreds of magnets. Magnets are particularly crucial in EVs because magnets shift electricity into motion at the wheel. No magnets, no motion.

The implied risks go far beyond the automotive industry. America’s F-35 fighter jet contains almost 900 pounds of rare earth metals.

China’s Dominance in Rare Earths

Refining and Processing: 90%

Manufacturing: 93%

That’s not the worst part. China is also restricting access to the machinery to make those crucial inputs. They [China] want to pull everybody else down with them,” Treasury secretary Scott Bessent said this week. “Maybe there is some Leninist business model where hurting your customers is a good idea.”

Source: FT. October 14 2025.

China’s fierce escalation did to come out of nowhere. In August, China’s top trade negotiator, Li Chenggang, warned Americans that he was ready to play hard ball. “He was pretty unhinged and very aggressive,” said one US official present at the meetings, stating that “the US would face a hellfire if things did not go his way.”

Maybe Bessent is right. Maybe China is following a Leninist playbook. Look at China’s undefeated record using overwhelming scale and predatory pricing power to take over industries from solar panels to ship-building to drones.

The pain for Western automakers is real. As a group, they are selling eight million fewer vehicles in China than they did five years ago. Eight million. Now they are under siege at home, especially in Europe. German automakers this year will produce the fewest number of vehicles (outside of the 2008 financial crisis and Covid shock) since 2000.

Volkswagen, Mercedes and Bosch - perennial blue chip corporations – are closing plants and laying off tens of thousands of workers.

What Now?

China’s playbook is clear, and it’s working: Scale up. Flood in. Starve out.

What’s less clear is how the rest of the world will respond. The auto industry, long built on global supply chains, now finds itself at the mercy of a single nation’s industrial policy. This is no longer just an automaker’s problem. It is a question of economic security, industrial survival, and strategic independence.

The real test now is whether companies and governments can work together to build new and reliable supply chains and secure access to the materials that power the modern world.

If the world does not act collectively, it could soon wake up to find the entire mobility industry — and the technologies that flow from it — running on China’s terms.

What do you think? Can the West – Europe, Japan, Korea, Australia, America – move quickly enough to build a truly independent automotive ecosystem, or is the gap already too wide to close?

So I guess the automakers didn't see the rise of China coming? If they did see this this coming, why were American automakers buying back stock instead of building capacity and cultivating talent?

Thank you for useful information and emphasis. I think your references to remarks quoting Bessent and Leninism are not useful. Bessent may be considered one of the architects of the US’s suicidal economic policies.