The Great China Car Blitzkrieg

Record Exports Are Shattering 100 Years Of Western Car Dominance

The Great China Car Blitzkrieg

Officials in Beijing may deny it. But – make no mistake – China has launched a global car blitzkrieg.

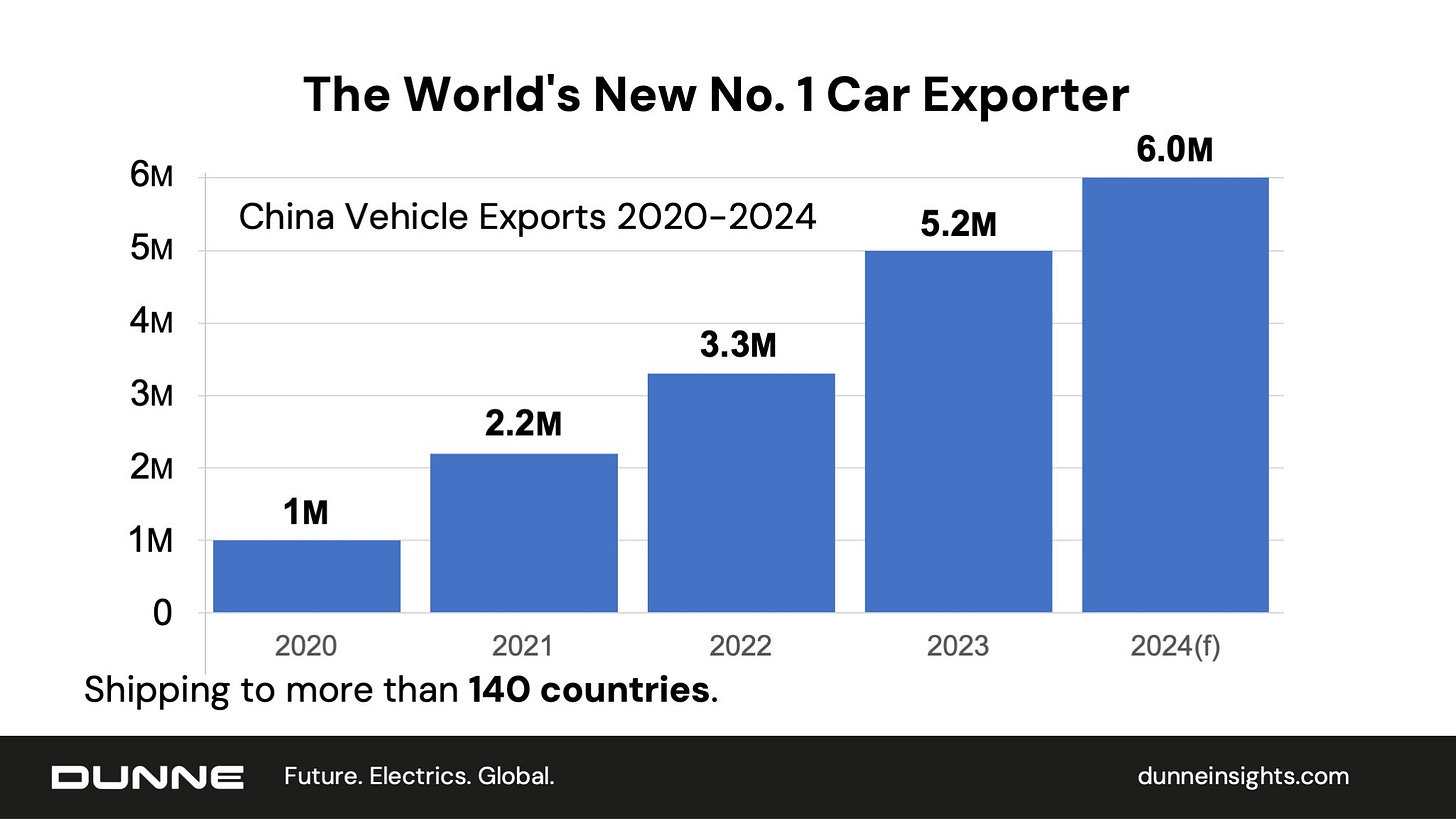

China will export a stunning 6 million cars to more than one hundred countries this year, cementing its position as the world’s No. 1 exporter.

The average price of those made-in-China cars: $19,000. That’s less than half the average price of a new car in America and Europe.

Consumers in every time zone are leaving their Chevys, VWs and Hondas in favor of new models from Chery, MG, Changan and BYD.

Dramatic Changes

The sudden flood of Chinese cars is upending decades of stable market shares and profits.

Take Thailand for example. A friend – and veteran car dealer based in Bangkok – gets frequent quotes from Chinese automakers these days.

“One guy in China – and he sounded very confident – said he can deliver a Territory replica for just $8,000,” recounted my friend. “Look, I sell the real Ford Territory here starting at $32,000. Can you imagine?”

His words gave me a flashback to the 1990s and 2000s when I was building our first company in Bangkok. Thailand was then known as “Japan’s backyard.” And for good reason. Japanese brands utterly dominated the market, year in and year out, taking more than 90% of the market.

No more.

In the first half of 2024, BYD’s market share jumped to 5%. Every Japanese brand, including Toyota, saw sales drop. Honda was forced to close a plant. And Suzuki is exiting the Kingdom.

Brazilian Boom

Thailand is just one example. Another is Brazil, the world’s 6th largest car market. Chinese automakers sent 175,000 cars there in the first half, a 450 percent increase over the same period in 2023.

You read that right – 450 percent. How to explain the sensational growth?

“The governments of China and Brazil are getting closer,” an executive from a leading dealer group in Sao Paulo told me this week, hinting at China’s geopolitical charm offensive. “Aggressive pricing and good products are part of it, too.”

Chinese gains means fresh pain for existing automakers. Count Chevy, Jeep and Fiat among the walking wounded. As a group, they lost more than 125,000 Brazilian customers to Chinese brands in the first half in 2024.

Source: CAAM, Dunne Insights.

Who Are These Guys?

By now the industry recognizes BYD as China’s leading automaker. The company recently raised its full year sales forecast to 4 million, just a few small steps behind Ford.

But BYD is not China’s top exporter. At least, not yet. Instead, its three largest car exporters are Chinese state enterprises.

China’s Top 5 Exporters - 2024

Chery: 1.25 million

SAIC: 1.1 million

Changan: 620,000

Geely: 500,000

BYD: 500,000

Note: Forecast based on data from CAAM, CPCA, Company Reports.

Sticker Shock & Specter

While Chinese automakers steal chunks of market share, Japanese, European and American competitor appear to have no response. They are confused and overwhelmed by the speed and strength of the Chinese offensive.

The prices of the Chinese exports in particular shock them. Who can compete with $19,000?

China’s frightening car prices are a product of a powerful national arsenal that may be impossible to duplicate.

China has unmatched scale, speed, supply chains and every variety of subsidies. Ships, too. BYD and SAIC have their own Roll-on/Roll-off vessels to transport cars across oceans.

Elon Musk understands China’s decisive manufacturing advantages. It is no coincidence that his Shanghai gigafactory presently accounts for half of Tesla’s total global production.

So here’s the question of the year: If China can jump from 1 million exports in 2020 to 6 million in 2024, what is to stop China from shipping 12 million annually by 2028?

And what is to stop China’s mighty car blitzkrieg from shattering 100 years of Western car dominance?

This is the new and unsettling specter that ruins the sleep of automotive leaders outside of the People’s Republic of China.

• • •

Michael Dunne

September 18 2024

www.dunneinsights.com

How do these companies achieve these prices?

Automation?

Slave labour?

Government subsidization?

The North American response to date is to double the sales price of Chinese manufactured vehicles imported into Canada and the US.

But that still leaves the prices lower than those manufactured in Canada, United States and Mexico.

Why are these prices so high?

Profit?

High wages/lack of automation?

Lower government subsidies?

US car manufacturers have had an oligopoly of 3 manufacturers that haven't had serious domestic competition since the 1920s. They failed to successfully respond to the Japanese since the 1970s, other than make big SUVs and trucks, and with their allergy to innovation they will not likely have a successful response to Chinese competition. The US government will probably need to provide subsidies to new domestic manufacturers to have a chance in preserving domestic car production or allow the Chinese to own factories in the US.