The Great China Joint Venture Boomerang

How Global Automakers Are Accelerating Their Own Demise

By Michael Dunne

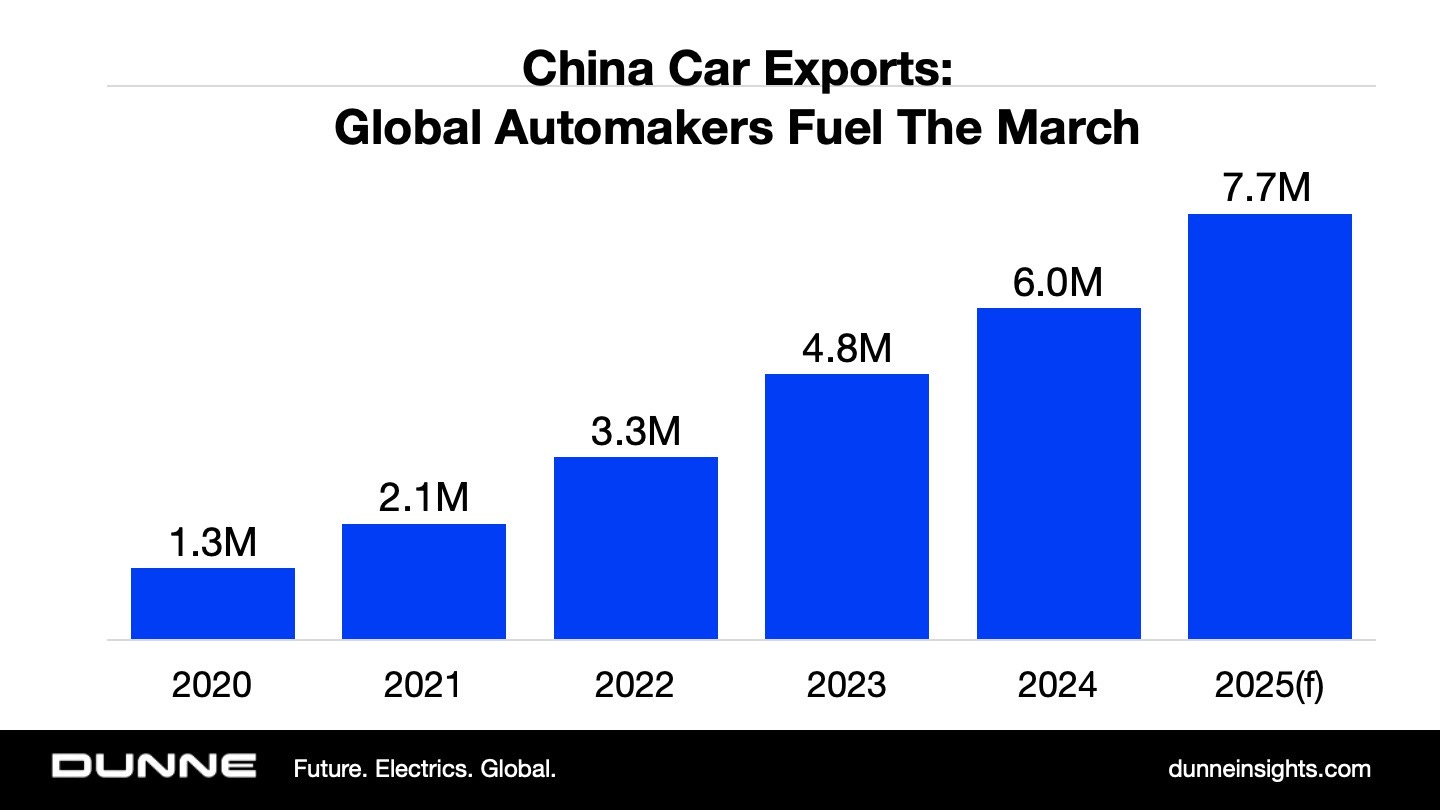

The wake-up call nobody wanted to hear just arrived: China is on track to export up to 8 million vehicles in 2025, and your favorite Western brand is helping them do it.

The Numbers Don’t Lie

Last month, China reported exports of 666,000 cars. At this pace, the Middle Kingdom will ship nearly 8 million vehicles in 2025, shattering last year’s record. And remember, in 2020, China exported just one million cars. That’s an eightfold increase in five years!

China didn’t just become the world’s largest car exporter by accident. They convinced global automakers – virtually the entire industry – to do something that was once unthinkable: export vehicles manufactured by Chinese joint ventures to global markets, splitting profits 50/50 with their Chinese partners.

This was a catastrophic strategic error that will haunt the global automotive industry for decades.

How We Got Here: The Devil’s Bargain

When I first arrived in China in the 1990s, the deal was simple and brutal. Want access to the world’s largest automotive market? You’ll partner 50/50 with a Chinese company in a joint venture. You’ll surrender half your profits. You’ll transfer your technology. Take it or leave it.

And everyone took it. GM, Ford, VW, BMW, Mercedes, Toyota, Honda, Nissan, Peugeot, Citroën, Hyundai, Kia – virtually every major global automaker lined up to sign these agreements. By the 2000s, joint ventures with Chinese partners controlled approximately 90% of China’s passenger car market.

The critical question some of us asked back then: Would these joint ventures ever export FROM China?

I discussed this with automotive executives throughout the 2010s. The consensus was crystal clear: Absolutely not! Over breakfast in Beijing one morning about ten years ago, I put the question directly to a senior VW executive:

“Would VW ever allow models built at its joint ventures to be exported from China?”

“Not possible,” he answered immediately. “Exporting from the joint venture would be suicidal. We would never, ever go there.”

Western OEMs would not risk becoming dependent on Chinese partners for global production. They would never voluntarily give up 50% of their profits in markets outside China. They’d build dedicated plants in Mexico, Thailand, Eastern Europe – anywhere but China – for their export needs.

That consensus held… until it didn’t.

Fast-forward to 2020: The Turning Point

VW and other global automakers were zealous about not exporting from their Chinese joint ventures for a very long time. That ended in 2020.

Tesla’s Shanghai Gigafactory ramped up production in early 2020 and flipped the Chinese market almost overnight, pulling domestic buyers into EVs and away from the internal-combustion models that joint ventures were built to produce.

Then COVID-19 hit, leaving joint-venture factories with massive overcapacity just as the market was pivoting sharply toward electrics.

By the end of 2020, global OEMs were staring at idle plants, excess inventory, and urgent revenue pressure. And with China building cheaper than anyone else, exporting from the joint ventures stopped being a mortal sin. It became a panicked short-term move to relieve financial stress.

The Staggering Scale of This Shift

Today, global automakers are exporting record numbers of vehicles from China – millions of them. Here are the stats that should keep every Western automotive executive awake at night:

General Motors: ~ 312,000 vehicles exported from China in 2024 – up 65% in two years. Chevrolets and Buicks sold in Mexico, South America, and Southeast Asia, all sharing 50% of profits with Chinese partners.

Ford: Over 170,000 vehicles exported, up 60% year-over-year. Equator Sport, Mondeo – all “Made in China,” all splitting profits. That Lincoln Nautilus in your driveway? Made at the Changan-Ford plant in Hangzhou.

BMW: ~ 110,000 units exported, with China as the global hub for electric MINI.

Hyundai: Exported 118,000 vehicles in the first half of 2025 alone.

Renault: More than 100,000 Dacia Spring models have shipped from its Dongfeng JV factory in Wuhan to Europe since 2023.

Other global automakers are capitulating, too. In September, VW started exporting Magotan and Sagitar models from its FAW-VW joint venture in Changchun. Mazda is working with Chinese partner Changan to develop products for export including the CX-6e and the EZ 60.

Western brands are paying Chinese companies to manufacture their vehicles, giving away half the revenue, and creating a dependency that cannot be easily undone.

Mexico: The Canary in the Coal Mine

Want to see the future? Look at Mexico.

MG Motor – owned by SAIC – sold over 60,000 vehicles in Mexico in 2024, becoming the best-selling Chinese brand. But SAIC is also building Chevrolets for GM and exporting them to Mexico.

SAIC splits Chevrolet revenue 50/50 with GM. SAIC keeps 100% of MG revenue – using some of the same platforms.

Of the top 5 Chevy models sold in Mexico, four of them are built in China by GM’s JV partners. Without SAIC, GM’s market share in Mexico instantly evaporates. But SAIC can thrive with or without GM.

That’s not a partnership. That’s a dependency. And dependencies become vulnerabilities.

Brand Erosion Nobody Wants to Discuss

Consumers aren’t stupid. They’re increasingly aware that their “Chevrolet” is built by a Chinese company in a Chinese factory. They see MG vehicles – which often share platforms, technology, and suppliers with Chevrolet models – but cost significantly less.

How long before consumers ask: Why am I paying a premium for a Western badge on what is essentially a Chinese car?

As brand value diminishes, the leverage shifts entirely to Chinese manufacturers. They’ll eventually conclude they no longer need Western partners. Why split revenue when you can keep it all?

The Endgame: Brands Without Factories

In the not-too-distant future, global OEMs risk becoming what they once feared most: brand and distribution companies that don’t actually make anything.

Chinese JV partners control manufacturing and they dominate the supply chains.

What happens when Chinese OEMs decide they’d rather just acquire the Western brand outright? We’ve already seen it with Volvo (Geely) and MG (SAIC). Which brand is next: Opel, Fiat, Maserati – Jeep?

The pattern is clear: First, you partner with them. Then, you depend on them. Finally, they acquire you – or simply replace you.

Not Just About China’s EV Dominance

The narrative you’ve been sold is that China wins EVs while legacy automakers retain their advantage in traditional vehicles. That narrative is dead wrong.

78% of the 6.4 million vehicles China exported in 2024 were conventional internal combustion engine vehicles.

China is dominating BOTH. They’re exporting 5 million gas-powered vehicles annually while simultaneously building the world’s largest EV industry.

Why? Because China has massive overcapacity in traditional automotive manufacturing – the result of years spent building factories for foreign JV partners while the market has pivoted to EVs. Rather than let factories sit idle, Chinese manufacturers are exporting their own gasoline-powered vehicles at aggressive prices to Russia, Mexico, the Middle East, South America, and Southeast Asia.

They’re using that revenue to fund their EV ambitions while Western automakers struggle to make EVs profitable.

Western OEMs aren’t just losing the EV race. They’re losing everything.

The Hard Truth

Global automakers made a choice. Faced with overcapacity and short-term pressure, they chose expediency over strategy. They chose quarterly results over long-term independence. They chose cost savings over control.

Nobody forced them to export from China. Nobody forced them to give Chinese partners 50% of global profits.

These choices have consequences.

Chinese OEMs now have the manufacturing scale, the technology, the cost structure, and increasingly the brand recognition to compete anywhere in the world.

And Western OEMs handed them the blueprint.

What Happens Next?

It’s going to be very difficult for global automakers to escape this trap.

Building new manufacturing capacity outside China takes 3-5 years and billions in capital investment. Automakers are simultaneously trying to fund EV transitions, develop autonomous technology, and navigate trade wars.

Instead, look for the joint ventures to continue. The exports will grow. The dependency will deepen.

And one day – maybe five years from now, maybe ten – we’ll look back at this moment and recognize it for what it was: The moment when global automakers, in pursuit of short-term efficiency, surrendered long-term strategic advantage to China.

The question is whether any Western automaker will remain truly independent, or whether they’ll all eventually become brand managers for vehicles manufactured and controlled by Chinese companies.

Based on current trajectories, the only real thing to watch is which Western automaker surrenders first.

Michael Dunne founded two companies in Asia and later led global corporations in China and Indonesia. He speaks Chinese and Thai and has decades of on-the-ground experience in Asia. His insights on global automotive trends have appeared in major publications, including Fortune, The Wall Street Journal, The New York Times, and the Financial Times.

Dunne Insights LLC — a boutique consultancy advising investors, automakers, government agencies, and technology companies — helps clients identify opportunities, anticipate risks, and navigate the fast-changing mobility landscape. Visit dunneinsights.com to learn more.

What’s your take? Are Western automakers in trouble, or is my point of view too alarmist? Share your thoughts in the comments.

Michael, I worked in the VW Asia Pacific HQ in Hong Kong from 94-97 and at VW Group Singapore from 97-00. I remember having lunch with you on a few occasions and discussing this exact scenario. We all knew this was where we would end up. But no OE (or the executives that worked for them) wanted to be the one to halt forward progress. So here we are. Remember in 1994 when the Chinese hosted The Family Car competition? They hoovered up the strategy papers and prototypes and in the end nothing ever came of that event. For the OEs, anyway.

I see the need for western countries to retain heavy industry and compete in the global auto markets, but these discussions are too often framed in terms of what happens to VW, GM, etc. and their employees. What about the rest of us? Americans would benefit A LOT from having access to Chinese EVs. Competition is good and prices of most American cars and trucks are way too high for most people. A middle ground is necessary that lets BYD and other Chinese car companies into the market in a guarded way. Quotas on imports, and having them do some manufacturing in the US and Canada. Force them into joint ventures like they did to western companies.

GM and Ford need to step it up and compete. Same goes for others like Rivian which is innovative but strikes me as very slow moving compared to the Chinese.