VinFast: A Stunning Comeback

Winning At Home And In Southeast Asia

No one can say this is a total surprise, but few could have predicted the speed and magnitude of disruption.

VinFast, Vietnam's EV champion, is taking its home market by storm, upending perennial market leaders.

Just two years ago, Japanese and Korean brands dominated the Vietnamese car market, accounting for nine of the ten best-selling cars in Vietnam. VinFast's only model in the running was the Fadil, a modest city car modeled after of a ten-year old Opel.

Blink twice and everything has changed. Through the first six months of 2025, VinFast has the three best-selling cars and now accounts for almost 30% of the new car market.

Best-selling Vehicles 1H 2025

VinFast VF3: 23,083

VinFast VF5: 21,812 (+232%)

VinFast VF6: 8,552 (+257%)

Mitsubishi Xpander 6,591 (flat)

Ford Ranger 6,231 (flat)

Source: Global Data

At its current pace, VinFast could deliver 200,000 vehicles this year, double the number in 2024.

What is going on?

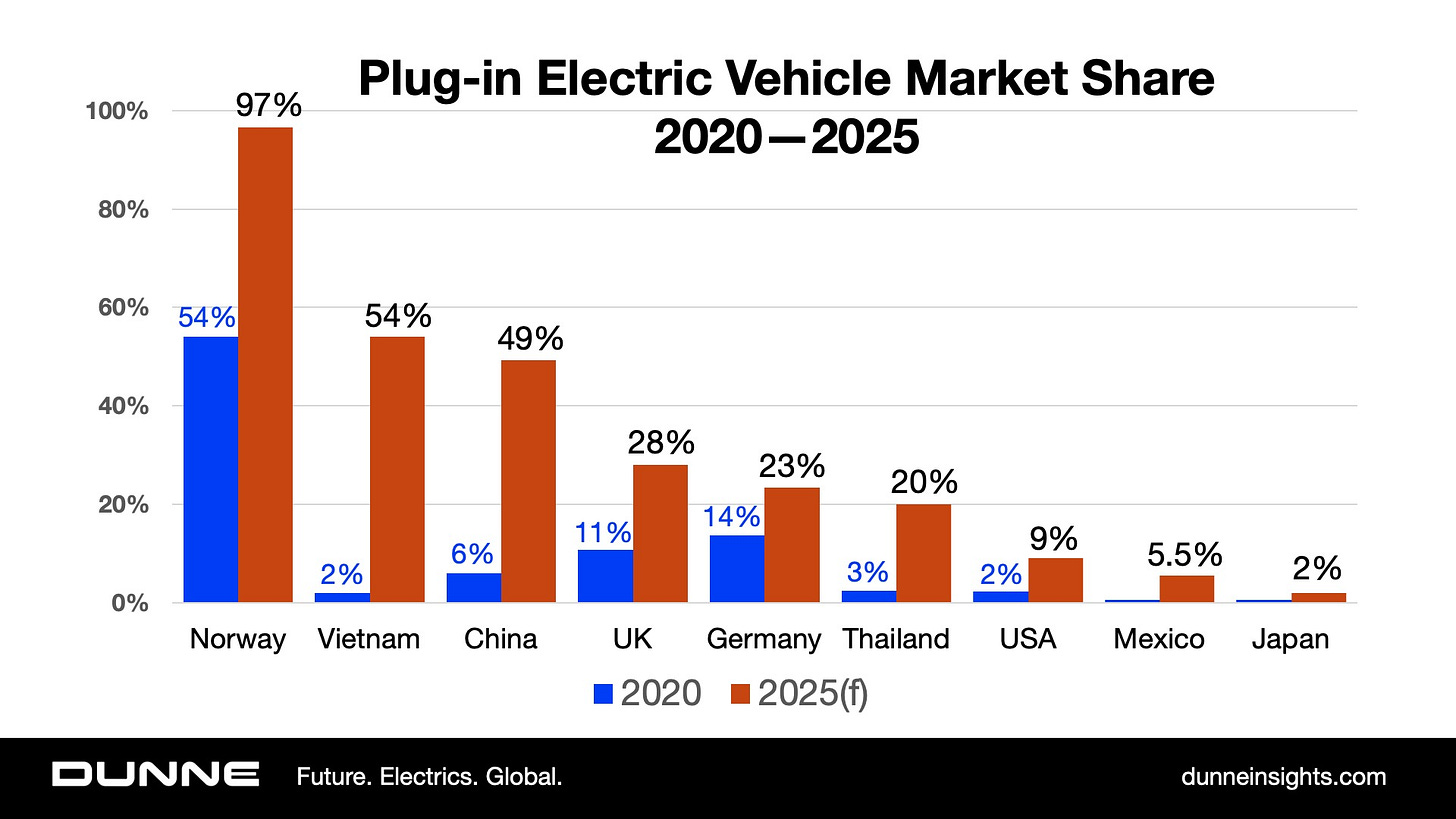

Just as we saw in China, the shift to EVs and home brands came slowly – then all at once. According a recent report by Ilaria Mazzocco of the Center for Strategic and Internal Studies (CSIS), EVs are on track to exceed 50% of new car sales in Vietnam this year, up from just 3% in 2022.

In its early years, VinFast struggled to impress customers. Efforts to enter and compete in America went nowhere after a series of brutal test drive reviews.

VinFast did not buckle. When I visited VinFast headquarters last year, top executives were quick to acknowledge the issues and promised they were moving fast to fix them.

Policies Help Shape Outcomes

Vietnam, home to 101 million people, has announced a couple of pro-EV polices with teeth. First, Hanoi mandated that some urban areas of the capital must run on electric or clean energy vehicles by July, 2026. Second, EVs are exempt from a national 12% registration tax.

V-Green, an independent company founded by VinFast Chairman Pham Nhat Vuong, is building Vietnam’s equivalent to the Tesla nationwide Supercharger network. It has already installed 150,000 charging portals nationwide. V-Green benefits from government subsidies for electricity that flows to charging stations.

Overseas Markets

VinFast is now exporting vehicles to neighboring markets, including Indonesia, the Philippines and Laos. The $20,000 VF3 city car is getting the most traction.

Transplants are part of the VinFast master plan, too. Last year, VinFast broke ground on a $200 million plant in Indonesia. This week, VinFast also opened a new manufacturing plant in India.

Financial Work to Do

One remaining hurdle - and it’s a tall one – is financial. VinFast lost almost $720 million in the first quarter of 2025, more than Lucid and Rivian over the same period. Every automotive startup is beset by massive financial losses until they reach escape velocity, which is in the range of 300,000 cars a year.

A Nation’s Pride

Will VinFast clear that bar? Time will tell. But as I have written earlier, you don’t want to bet against Vietnamese perseverance and tenacity. Just ask France (1954), America (1968) and China (1979).

To be sure, VinFast enjoys tacit backing of Vietnamese leaders, provided the company continues making progress. Short-term losses are tolerable if they lead to eventual national triumph.

But VinFast’s new momentum is really a result of consumer preference for good-looking, technologically-advanced electric vehicles at the right price, backed by an ubiquitous charging infrastructure.

The Next Arena

Vietnam won’t unseat China as the global EV powerhouse. But in the fight for non-Chinese markets, especially in Asia, VinFast is fast becoming a serious contender. Japan and Korea should be watching closely. The next battleground isn’t Detroit or Wolfsburg. It’s Jakarta, Manila, and Bangkok.